Fiduciary benefits Level UP Geneva

-

Our expertise

Level UP is a Swiss company specializing in professional services for businesses.

We offer a full range of services to support entrepreneurs in the creation and management of their business with quality expertise.

-

Your personalized support

We offer personalized support to help you navigate the challenges of setting up and running a business in Switzerland.

We help you maximize your economic performance and focus on growing your business.

-

Our International Network

With our 3 sites spread throughout French-speaking Switzerland, we are always at your disposal to offer you a professional and personalized service.

Trust Level UP to support you in setting up and managing your business in Switzerland, no matter where you are.

Gratuités

-

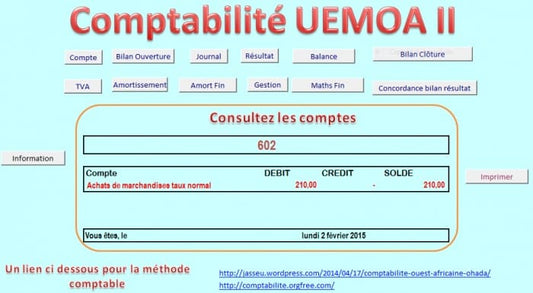

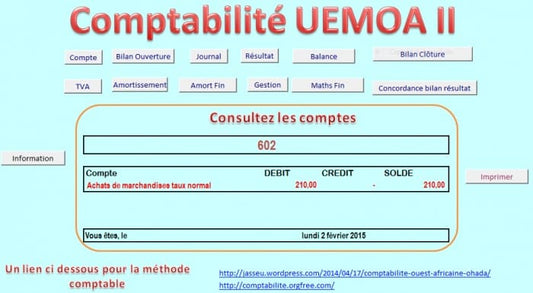

License de logiciel Comptabilite UEMOA II

Regular price CHF 0.00Regular priceUnit price per -

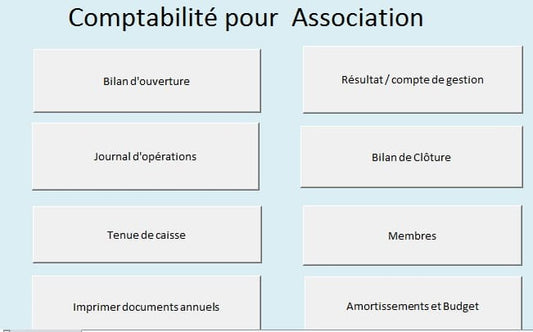

Logiciel comptable pour association GRATUIT

Regular price CHF 0.00Regular priceUnit price per

Fiduciary LEVEL UP Geneva

Level UP is a leader in company formation services in Switzerland , offering particular expertise to innovative start-ups in various fields such as the production of chocolate in Valais and the cocoa trade from Cameroon, but also the building, architecture, but also blockchain, CBD and real estate investment or new patented medical gene therapy.

We have successfully contributed with companies such as Isla Blockchain, the first pioneering company in the realization of a Saudi Sharia Compliant blockchain.

By choosing Level UP for your company creation , you also benefit from access to our community of Swiss and international entrepreneurs active in these fields.

We also offer a full set of services to support businesses once established, including:

- Accounting to effectively manage your business finances

- Human resources management to effectively recruit and manage your staff

- Legal advice to navigate the legal complexities of running a business in Switzerland

Additionally, we have a start-up incubator to support start-up entrepreneurs on their entrepreneurial journey.

The selected start-ups benefit from personalized support to develop their project and access financing for their development.

Choosing Level UP for your company creation not only means benefiting from quality legal, tax and accounting expertise , but also access to a network of entrepreneurs and financing to support your growth.

LEVEL UP Gestion

SA start-UP pack

Share

Level UP training

LevelUP Gestion - Your trusted partner for optimized financial management and sustainable growth.

FAQs

Sole Proprietorship (RI)

Sole Proprietorship (EI), known as Sole Proprietorship (RI), gives you the freedom to

manage your activities independently and make decisions without the approval of other associates. In

On the other hand, two or more people having particular affinities and who wish to combine their

know-how can create a general partnership (SNC). The latter operates on the same

principle than a sole proprietorship.

Limited Liability Company (Sàrl)

The limited liability company (Sàrl) is interesting if you want to create a

capital and whether you consider the financial risks to be significant. The minimum capital required to create

a Sàrl amounts to CHF 20,000. It can be set up by a natural or legal person. Is the

during a constituent assembly that you formalize its creation. We will introduce you to a

partner notary with whom you will sign a deed in authentic form expressing your

desire to start the business.

Public limited company (SA)

The public limited company (SA) is created by a natural or legal person before a notary during a

constituent assembly. The minimum capital required to create an SA is CHF 100,000. It is at the

both taxed on capital and on profit.

Registration in the Commercial Register

It is interesting to note that all these structures must be registered in the Registry of the

trade. You must also register your sole proprietorship if its annual turnover

forecast exceeds CHF 100,000.

VAT

Whatever the structure chosen, an entry in the VAT register (Value Added Tax)

is mandatory if its forecast annual turnover exceeds CHF 100,000. (Turnover and

not Profit).

Voluntary registration is possible and recommended.

Reduction of the Tax Rate in Switzerland 2022

Taxation of business profits is lighter in Switzerland. The rate rose to 14.7% on average nationally in 2022, with significant cantonal disparities, against 14.9% a year earlier, indicates the audit firm KPMG in its annual report Swiss Tax Report.

7. How do you ensure the confidentiality of my financial information?

We understand the importance of the confidentiality of your financial information.

At LevelUP Gestion, we implement strict data security measures to ensure the confidentiality and protection of your information.

We maintain the highest standards of privacy and are committed to protecting your data.

8. What region do you cover?

Although based in Geneva, we work with clients throughout Switzerland and even internationally.

We are able to provide remote services through advanced tools and technologies, allowing us to work effectively with clients all over the world.

9. How does your pricing work?

Our pricing depends on the specific services you require. We offer competitive and transparent rates, adapted to each client and each project. We discuss the costs from the start of our collaboration to offer you complete transparency.

10. How can I start working with LevelUP Gestion?

To start working with us, all you have to do is contact us to arrange a completely free initial consultation .

During this consultation, we will discuss your needs , your objectives and the best way to collaborate together.

We'd love to help you take control of your finances and propel your success.